Vendor Contract Negotiations

Secure Greater Savings, Optimal Terms, and Incentives

Speak with an expert today

For over 15 years, ADVANTAGE has been helping community banks and credit unions evaluate current technology, source new vendors, and optimize contracts.

Align Vendor Services with your Goals

Through our expertise and deep understanding of the market, we ensure your vendors are strategic partners who align with your vision and that you have the technology that will propel your growth.

The ADVANTAGE Difference

With over $159M in savings delivered and 98% success in achieving cost reductions, our results speak for themselves.

We go beyond savings to ensure:

- Vendor relationships built on trust and transparency

- Enhanced service standards to meet your institution’s evolving needs

-

Comprehensive discovery eliminates redundant solutions and improves efficiency

How can a negotiation expert benefit my financial institution?

Vendor contracts are one of the most significant cost components for financial institutions, yet they are often underutilized as a strategic tool. Professional negotiation can uncover:

- Hidden savings

- Improved terms and service upgrades

- Revenue-generating opportunities

ADVANTAGE helps you take control of these vital agreements, creating not only cost savings but also stronger vendor relationships that drive long-term value.

Vendor relationships built on transparency and trust

ADVANTAGE provides unmatched expertise in vendor negotiations, ensuring clients achieve the most competitive rates in the market. Drawing on a robust data lake of 15 years of pricing insights, ADVANTAGE consultants benchmark vendor pricing to secure favorable terms and unlock cost-saving opportunities.

Whether negotiating discounts for new services with existing vendors or managing the intricacies of deconversion costs and scheduled rate increases, ADVANTAGE prioritizes your financial institution’s long-term success while preserving strong relationships with your account representatives.

Enhanced service standards to meet your institution’s evolving needs

ADVANTAGE’s contract management services go beyond price negotiation to focus on the critical terms and service-level agreements (SLAs) that underpin successful partnerships.

Our consultants, with deep roots in the financial industry, assess the impacts of your growth strategy, whether organic or through merger/acquisition.

By aligning vendor agreements with your institution's strategic goals and ensuring scalability, we position your organization for seamless growth and new product development.

Comprehensive discovery

A distinguishing feature of the ADVANTAGE approach is a commitment to thorough discovery. Our consultants engage with internal stakeholders to uncover operational gaps and inefficiencies.

This comprehensive discovery approach eliminates redundant solutions and improves efficiencies.

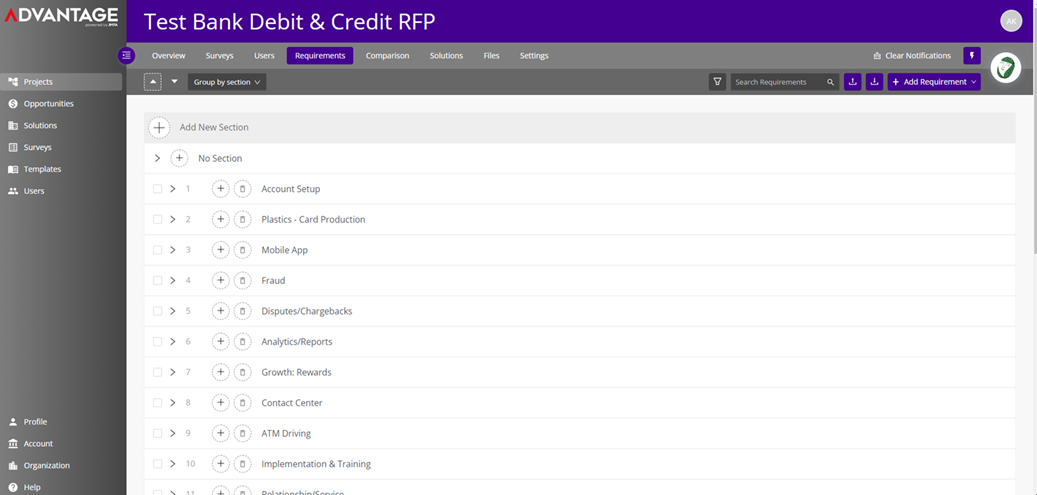

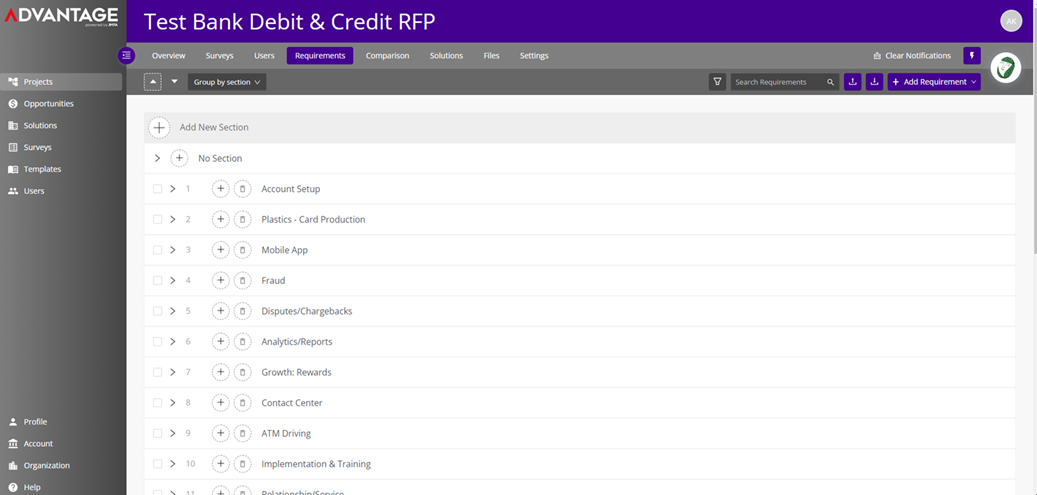

Tools for Vendor Selection and Evaluation

ADVANTAGE simplifies the often complex process of vendor selection with automated Request For Proposal (RFP) tools and a systematic vendor evaluation system.

We manage detailed analysis and comparisons of all proposal components, enabling informed decision-making at every step. From initial discovery to down-selection, we provide financial institutions with the confidence and clarity needed to choose the right partners for scalable growth and enhanced profitability.

Types of contracts we negotiate

- Core Data Processing

- Digital Banking

- Debit/ATM Processing

- Credit Card Processing

- Card Brand

- PIN Networks

- Surcharge-Free/Shared Branch Networks

- Loan Origination Systems

- Check Printing Services

Vendors we negotiate with

At ADVANTAGE, we pride ourselves on being a truly vendor-agnostic partner for community banks and credit unions. When it comes to negotiating contracts for your institution, our sole focus is on protecting your interests and ensuring you receive the best terms possible.

Being vendor agnostic means we have no affiliations, biases, or preferences toward specific vendors. This neutrality allows us to approach every negotiation with a clear objective: to secure outcomes that align with your strategic goals and financial priorities.

Our deep industry expertise enables us to:

- Evaluate contracts objectively to identify areas for improvement.

- Leverage market data to ensure competitive pricing and favorable terms.

- Advocate for your institution’s needs without any external influence.

Whether you're renewing a provider agreement or exploring new vendor relationships, ADVANTAGE serves as a trusted advisor. We work solely for your institution’s success, helping you navigate complex vendor relationships.

When you partner with ADVANTAGE, you can count on a transparent, client-first approach that puts your institution’s goals at the forefront of every decision.

How Much Can You Expect to Save?

One returning client saved $70,000/year over a 7-year term on their Debit/Credit Card Processing contract

This growing financial institution had used our contract renegotiation services in the past and wanted to see what we could do for them when their debit card processing contract was coming due. We were familiar with their current processor, as well as the other choices available to them. Our thorough analysis showed there were opportunities available to them.

Ultimately a straight renewal with their original debit card provider was decided upon where we were able to secure them $70,000/year in savings over a 7-year term with ADVANTAGE Contract Negotiations.

That ends up being close to $500,000 in savings over the life of the agreement. We believe it speaks volumes when we have clients return to us over and again as their vendor agreements come due.

A client received a savings of $280,000/year and close to $1,000,000 in savings over term of their Card Branding Agreement

It can be overwhelming to research all of the variables in pricing, terms and conditions when making such an important decision. That is why our client chose ADVANTAGE Contract Negotiations for reviewing their VISA card brand agreement.

After our review and careful negotiations, the recommendation was to stay with VISA. The institution received additional savings of $280,000/year totaling close to $1 million in savings over the 7-year term of the card brand agreement. This review and negotiation can take place in as little as 90-120 days – meaning your bottom line can be positively impacted in only 3-4 months’ time.

Our client saved $72,000/year over a 7-year period on their Core Data Processing Contract

One client was feeling overwhelmed with its normal day-to-day operations and needed some assistance as their core processing agreement was coming due. They decided ADVANTAGE Contract Negotiation could be the solution.

They contacted us 24 months before renewal – perfect timing to see how their existing core processor would respond to the review and negotiations. If the result wasn’t the very best proposal, we had plenty of time to look at other vendors and put the service out to bid. Starting this early can also give us the opportunity to negotiate retroactive savings.

In this particular case, the negotiations saved the institution $72,000/year over a 7-year period. Not only did we help them reduce costs, we saved them a huge headache by taking this task off of their plate so they could stay focused on their day-to-day operations and even larger strategic growth initiatives.

Another returning client saved $100,000/year on their Digital Banking contract – without switching providers

A client who had previously used us to negotiate their core processing agreement had an digital banking contract coming due and they reached out to us. They knew that we were familiar with the digital banking vendors, and that we had achieved great results for other clients.

Once we understood their specific needs, we sent the agreement out to bid. After negotiations, the decision was reached to stay the course with their original digital banking provider.

With ADVANTAGE Contract Negotiations, we secured an additional $100,000/year savings on their behalf. Another win for our client!

Our Services

Achieve greater savings, favorable terms, and incentives for your financial institution than you ever thought possible, all while nurturing respectful and positive relationships with your vendors.

Debit, Credit and ATM

We bring transparency and clarity to the card processing fee negotiations. Our debit and credit card negotiation services include renewals or sourcing new vendors.

Digital Banking and Bill Pay

We know the vendors, the competitive landscape, and the emerging trends that enable clients to better anticipate the needs, preferences and desired functionality demanded by consumers.

Core Data Processing

We leverage pricing data points acquired through 15 years of system selection negotiations, contract renewals and benchmarking engagements, along with our proven methodologies.

Card Brand

Our card branding negotiators assist our clients by soliciting bids and negotiating with the vendor(s) for market-ready agreements that reward our clients for their relationships.

PIN Networks

Surcharge-Free/Shared Branch Networks

Loan Origination Systems

Check Printing Services

.png)

Our 4-Step Process

1. Project Definition and Planning

-

Define the project scope, including objectives, timeline, and deliverables.

-

Conduct a thorough situational analysis to gather data and identify key issues.

-

Develop a detailed project plan with assigned roles and responsibilities.

2. Comprehensive Evaluation & Benchmarking

-

We access a proprietary database of vendor contracts for deep market insights.

-

Compare your contracts against peer institutions to identify opportunities for savings and improvement.

-

Evaluate contract cost components across critical service areas, such as core processing, card processing, and digital banking.

3. Strategic Negotiation

-

Develop tailored strategies based on your institution’s needs and market benchmarks.

-

Focus on key areas like service level agreements (SLAs), pricing incentives, and deconversion costs.

-

Use proprietary cost metrics to negotiate terms that are not only competitive but also sustainable.

4. Implementation & Integration

- Ensure vendor relationships remain positive throughout the negotiation process.

- Align contract terms with your institution’s strategic goals and technology roadmap.

- Support seamless vendor transitions when necessary, ensuring operational continuity.

Project Timelines

STEP 1

Project Definition and Planning

STEP 2

Comprehensive Evaluation and Benchmarking

Access a proprietary database of vendor contracts for deep market insights

STEP 3

Strategic Negotiation

STEP 4

Implementation and Integration

PEOPLE LIKE WORKING WITH US

Trusted By The Best

Video: How we get results

We help financial institutions get the very best deals from their vendors.

Watch now

Break Free from Legacy Systems

Blog Post: Break Free from Legacy Systems and Upgrade Your Core

Read the blog

Give Your Contracts a Closer Look

White Paper: Three Reasons to Give Your Contracts a Closer Look

DownloadLean On The Experts

You don’t have to do it alone. Our team of experts is waiting to help you.

Get Started