Account Acquisition & Deposit Growth

Empowering community FIs for sustainable growth

Speak with an acquisition expert

For over 40 years, ADVANTAGE has empowered community banks and credit unions to drive consumer engagement, increase profitability, and achieve sustainable growth.

Achieve unmatched Primary Financial Institution (PFI) account growth

Powered by cutting-edge technology, ADVANTAGE leverages actionable data, advanced analytics, and tailored support to deliver personalized campaigns that convert.

ADVANTAGE’s tailored strategies ensure your institution stands out in a crowded marketplace.

Through our unique approach, we help clients:

- Increase Account and Core Deposit Growth: Attract more core relationships

- Expand Low-Cost Deposits: Reduce reliance on high-cost funding by growing low-cost, stable deposits

- Boost Income: Increase income and cross sell opportunities

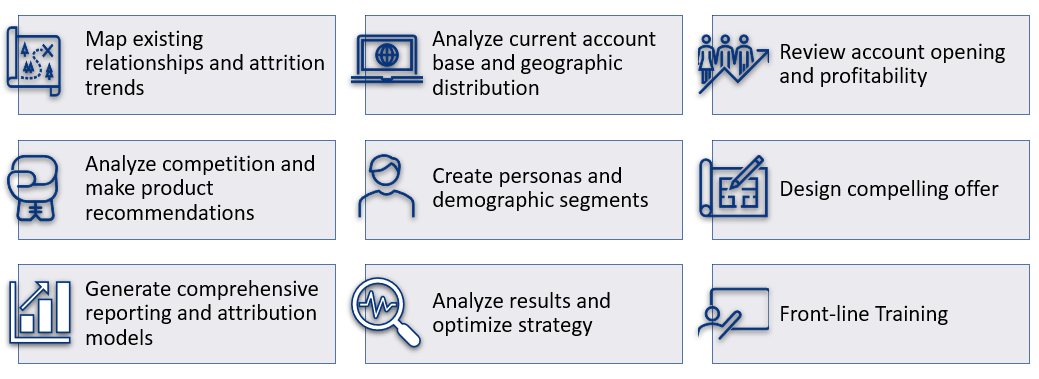

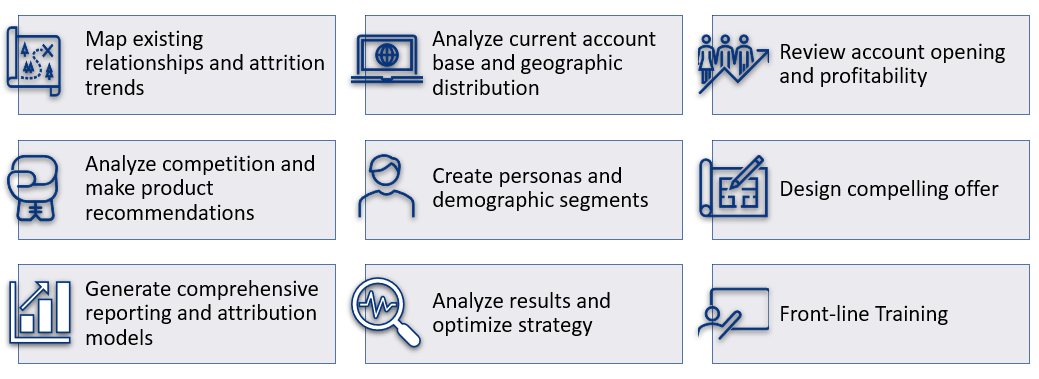

What we offer

Strategic Consulting

Unlock Opportunities Through Comprehensive Insights

- Collaborate to understand your unique growth goals—whether increasing core deposits, enhancing income, or achieving a specific market share target.

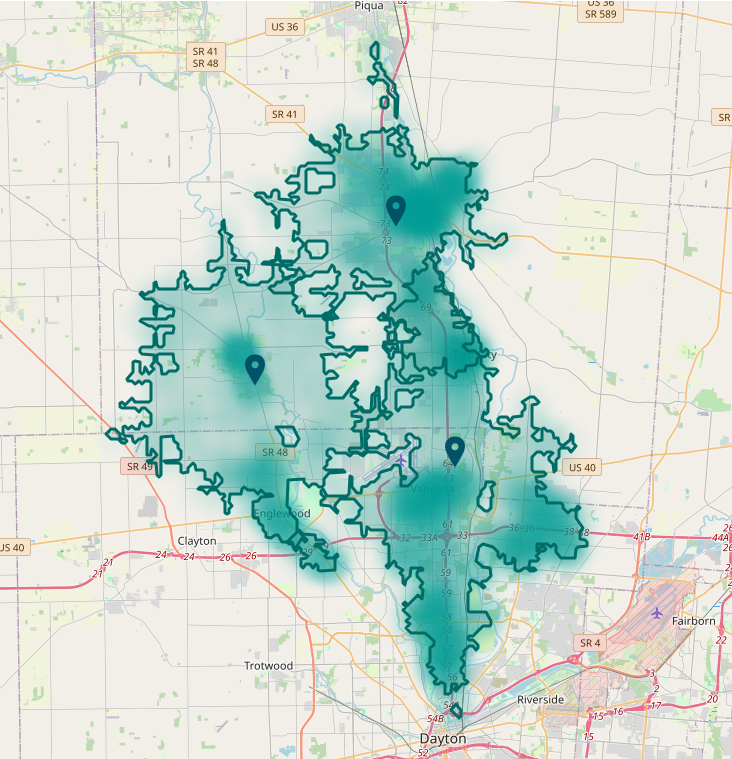

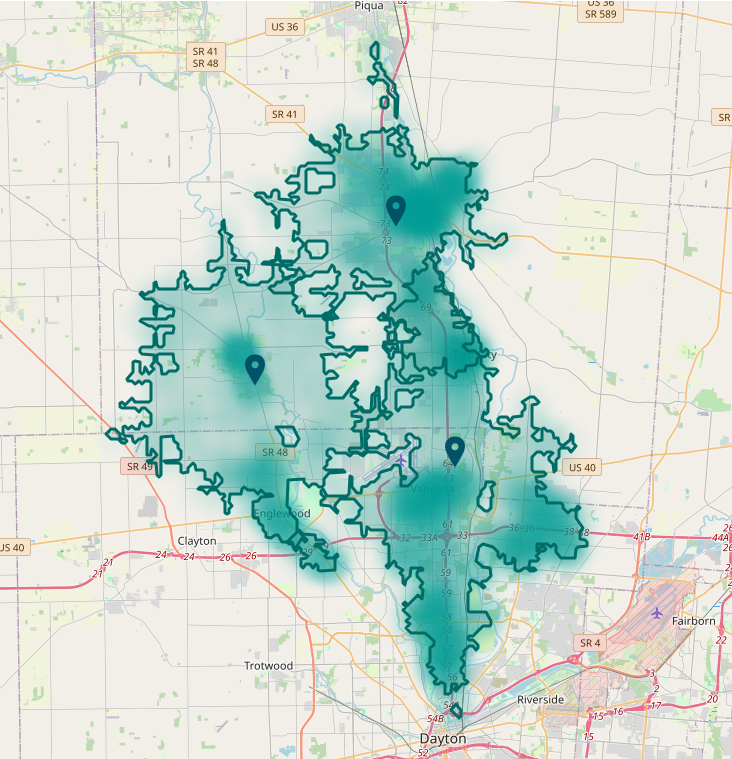

- Analyze current account holder geographic distribution to determine market saturation and opportunities.

- Deliver data-driven strategies to reduce cost of acquisition, maximize ROI, and improve operational efficiency.

- Provide actionable recommendations on offers, incentives, campaign timing, and frequency to ensure impactful results.

Comprehensive Analysis

- Complete in-depth analysis to understand your market share, branch footprint, and competitive advantages.

- Review your current account holder geographic distribution and market saturation.

- Evaluate your existing accounts, identifying key opportunities, demographic trends, and untapped potential to align your strategy with local needs.

- Conduct a thorough competitive analysis, assessing the strengths and gaps of your industry peers to position your financial institution for sustained growth and differentiation.

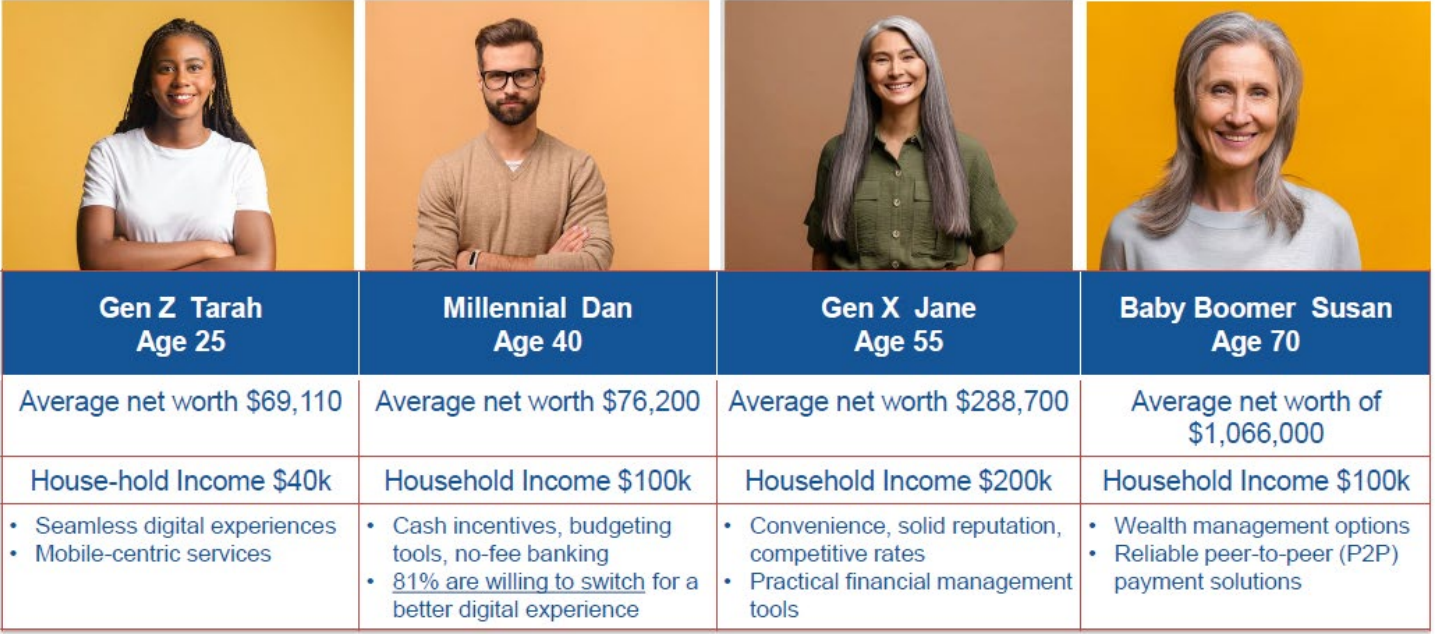

Audience Selection

Reach the Right People with Precision

- Define key demographics, behaviors, and preferences to ensure campaigns resonate with the right prospects.

- Segment current account holders into personas by using a combination of demographic data and life stage characteristics.

- Target prospect personas matching the identified segments to maximize engagement and conversion rates.

Targeted Marketing

Custom Campaigns Designed to Drive Results

- Design creative and messaging that reflect the unique identity of your financial institution and the distinct character of your local community.

- Incorporate localized imagery, messaging, and branding elements to create campaigns that resonate deeply with your target audience, fostering authentic connections and building trust.

- Implement expertly tailored campaigns, in your own brand voice, that maximize the impact of every marketing dollar while employing proven marketing methodologies to ensure measurable, high-yield ROI.

- Align personalization, creative design, and targeted strategy to ensure your FI stands out, delivering results that matter.

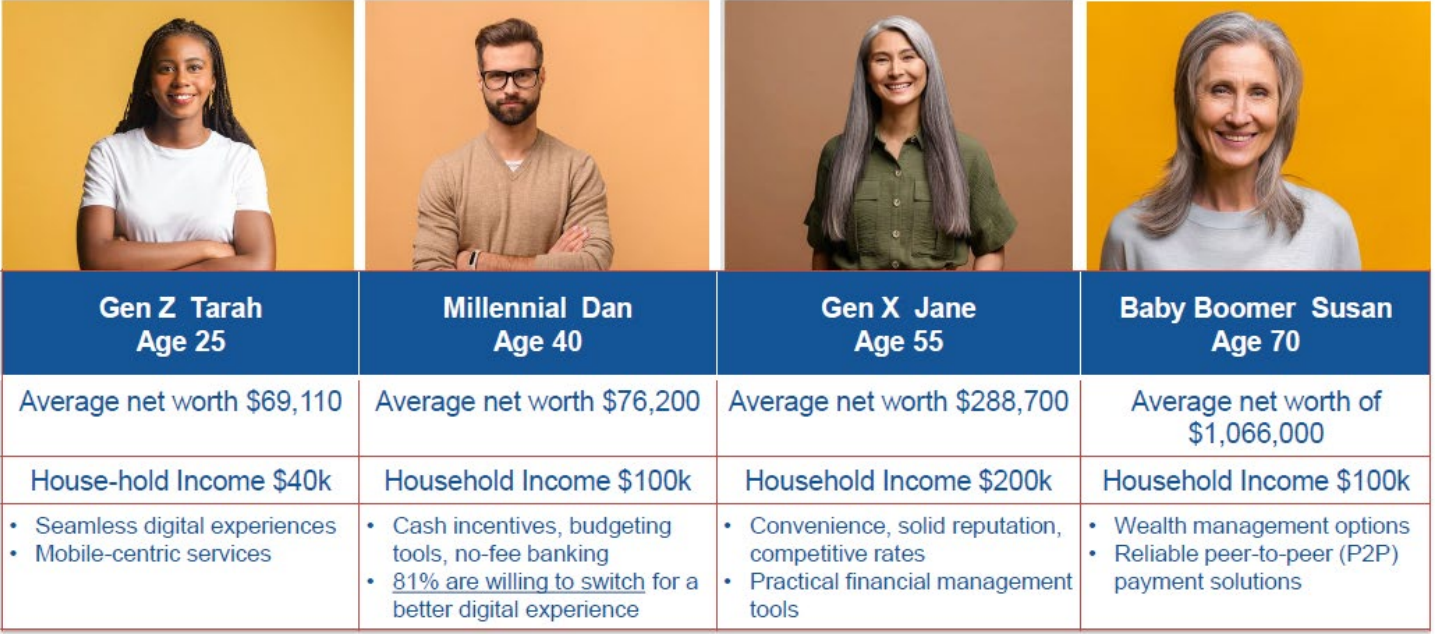

Comprehensive pro forma

Custom Campaigns Designed to Drive Results

- Leverage AI-driven creative development and advanced graphic design to craft compelling marketing assets

- Implement expertly tailored campaigns that maximize the impact of every marketing dollar

- Employ proven marketing methodologies to ensure your campaigns achieve measurable, high-yield ROI

Ongoing Analysis and Reporting

Continuous Optimization for Sustained Success

- Utilize advanced program management to monitor campaign performance and refine targeting strategies.

-

Leverage information about market disruptions such as competitor branch openings, mergers, acquisitions, branch closings, branch openings to take advantage of these opportunities.

- Adapt and evolve strategies to ensure your marketing dollars consistently deliver optimal results.

How can an account acquisition strategy benefit my financial institution?

Community banks and credit unions that prioritize a strong retail focus, embrace innovative product strategies, and harness the power of targeted marketing to drive results, can achieve remarkable growth through a well-executed account acquisition strategy.

A strategic approach ensures your institution attracts and retains the right customers, enhances profitability, and strengthens your competitive position in today’s dynamic financial landscape.

ADVANTAGE partners with community FIs to drive sustainable growth, improve profitability, and meet the evolving needs of their customers.

Our innovative strategies and cutting-edge solutions empower FIs to thrive in today’s competitive landscape. With a proven track record, we’ve helped our clients achieve measurable results, building a foundation for long-term success.

The ADVANTAGE Difference

We go beyond marketing execution to achieve unmatched growth.

- Strategy to acquire new Primary Financial Institution (PFI) relationships

- Increase brand awareness

- Acquire new accounts at the lowest acquisition rate

Strategy to acquire new PFI account holders

Data is the key to unlocking your institution’s full potential. By leveraging insights from millions of data points, we craft strategies that:

- Ensure your institution is the top choice for customers in your market.

- Align your products, policies, people, and marketing for maximum impact.

- Build enduring relationships that drive long-term profitability.

Increase brand awareness

ADVANTAGE helps community financial institutions enhance brand awareness by providing tools and strategies tailored to their unique values and local presence.

Brand awareness is vital to competing with larger institutions and digital-first competitors. Unlike larger institutions, community financial institutions can rely on personal relationships and trust to attract and retain customers.

ADVANTAGE amplifies these strengths by offering digital marketing solutions and data-driven insights to ensure their brand resonates with local audiences.

Acquire new deposits at the lowest acquisition cost

ADVANTAGE combines targeted marketing strategies with advanced analytics. We use data-driven insights to identify high-potential prospects in the local market, ensuring marketing efforts are focused on the right audience.

This precision targeting minimizes wasted resources, enabling institutions to attract new deposits more efficiently.

Another way ADVANTAGE reduces acquisition costs is by leveraging digital channels to reach prospective depositors where they are most active.

Through cost-effective platforms like social media, email marketing, and online advertising, ADVANTAGE enables community financial institutions to expand their reach without the expense of traditional advertising methods.

Data-Driven Strategies for Success

.png)

.png)

Types of contracts we negotiate

- Core Data Processing

- Digital Banking

- Debit/ATM Processing

- Credit Card Processing

- Card Brand

- PIN Networks

- Surcharge-Free/Shared Branch Networks

- Loan Operating Systems

- Check Printing Services

Vendors we negotiate with

At ADVANTAGE, we pride ourselves on being a truly vendor-agnostic partner for community banks and credit unions. When it comes to negotiating contracts for your institution, our sole focus is on protecting your interests and ensuring you receive the best terms possible.

Being vendor agnostic means we have no affiliations, biases, or preferences toward specific vendors. This neutrality allows us to approach every negotiation with a clear objective: to secure outcomes that align with your strategic goals and financial priorities.

Our deep industry expertise enables us to:

- Evaluate contracts objectively to identify areas for improvement.

- Leverage market data to ensure competitive pricing and favorable terms.

- Advocate for your institution’s needs without any external influence.

Whether you're renewing a core provider agreement, renegotiating service contracts, or exploring new vendor relationships, ADVANTAGE serves as a trusted advisor. We work solely for your institution’s success, helping you navigate complex vendor relationships while balancing profitability and compliance.

When you partner with ADVANTAGE, you can count on a transparent, client-first approach that puts your institution’s goals at the forefront of every decision.

How Much Can You Expect to Save?

One returning client saved $70,000/year over a 7-year term on their Debit/Credit Card Processing contract

This growing financial institution had used our contract renegotiation services in the past and wanted to see what we could do for them when their debit card processing contract was coming due. We were familiar with their current processor, as well as the other choices available to them. Our thorough analysis showed there were opportunities available to them.

Ultimately a straight renewal with their original debit card provider was decided upon where we were able to secure them $70,000/year in savings over a 7-year term with ADVANTAGE Contract Negotiations.

That ends up being close to $500,000 in savings over the life of the agreement. We believe it speaks volumes when we have clients return to us over and again as their vendor agreements come due.

A client received a savings of $280,000/year and close to $1,000,000 in savings over term of their Card Branding Agreement

It can be overwhelming to research all of the variables in pricing, terms and conditions when making such an important decision. That is why our client chose ADVANTAGE Contract Negotiations for reviewing their VISA card brand agreement.

After our review and careful negotiations, the recommendation was to stay with VISA. The institution received additional savings of $280,000/year totaling close to $1 million in savings over the 7-year term of the card brand agreement. This review and negotiation can take place in as little as 90-120 days – meaning your bottom line can be positively impacted in only 3-4 months’ time.

Our client saved $72,000/year over a 7-year period on their Core Data Processing Contract

One client was feeling overwhelmed with its normal day-to-day operations and needed some assistance as their core processing agreement was coming due. They decided ADVANTAGE Contract Negotiation could be the solution.

They contacted us 24 months before renewal – perfect timing to see how their existing core processor would respond to the review and negotiations. If the result wasn’t the very best proposal, we had plenty of time to look at other vendors and put the service out to bid. Starting this early can also give us the opportunity to negotiate retroactive savings.

In this particular case, the negotiations saved the institution $72,000/year over a 7-year period. Not only did we help them reduce costs, we saved them a huge headache by taking this task off of their plate so they could stay focused on their day-to-day operations and even larger strategic growth initiatives.

Another returning client saved $100,000/year on their Internet Banking contract – without switching providers

A client who had previously used us to negotiate their core processing agreement had an internet banking contract coming due and they reached out to us. They knew that we were familiar with the internet banking vendors, and that we had achieved great results for other clients.

Once we understood their specific needs, we sent the agreement out to bid. After negotiations, the decision was reached to stay the course with their original internet banking provider.

With ADVANTAGE Contract Negotiations, we secured an additional $100,000/year savings on their behalf. Another win for our client!

Our Services

Achieve greater savings, favorable terms, and incentives for your financial institution than you ever thought possible, all while nurturing respectful and positive relationships with your vendors.

Debit, ATM, and Credit Card Processing

We bring transparency and clarity to the card processing fee negotiations. Our debit and credit card negotiation services include: Debit | ATM processing renewals, PIN POS networks, debit and credit selections, credit processing.

Data Analysis

-

PIN/POS debit card transactions

- Card account file management

-

ATM residency fees

-

ATM terminal driving & support

- Card authorization transactions

-

Statement preparation & management

-

Fraud monitoring & reporting

-

Rewards revenue & expense

Digital Banking and Bill Pay

We help our clients evaluate options and negotiate more cost-effective contracts. We know the vendors, the competitive landscape, and the emerging trends that enable clients to better anticipate the needs, preferences and desired functionality demanded by customers.

Data Analysis

- Monthly per users fees

- Fees for internal transfers

- Fees for P2P transfers

- Fees for cash management services

- Cost for online account opening

- Cost for online loan origination

- Fees for site hosting & VPN

Core Data Processing

We leverage pricing data points acquired through 15 years of system selection negotiations, contract renewals and benchmarking engagements, along with our proven methodologies to get the most favorable contract pricing and terms.

Data Analysis

-

Cost per Open Account

-

Cost per Closed Account

-

Fee per ACH

-

Software Maintenance

-

Module & API Fees

-

Fee per ATM/Debit Card Record

Card Brand

Our clients benefit from substantially higher incentives and lower fees from Visa and Mastercard. Our card branding negotiators assist our clients by soliciting bids and negotiating with the vendor(s) for market-ready agreements that reward our clients for their relationships with these vendors.

Data Analysis

-

Principal or affiliate agreements

-

Visa, MasterCard, Discover

-

Conversion & launch support

-

Marketing funds

-

Volume-based incentives

PIN Networks

Surcharge-Free/Shared Branch Networks

Loan Operating Systems

Check Printing Services

Our Process

STEP 1

Project Definition and Planning

STEP 2

Comprehensive Evaluation and Benchmarking

STEP 3

Develop Tailored Strategies

STEP 4

Design and Implement Campaigns

STEP 5

Analyze and Optimize

PEOPLE LIKE WORKING WITH US

Trusted By The Best

Video: How we get results

We help financial institutions get the very best deals from their vendors.

Watch now

Break Free from Legacy Systems

Blog Post: Break Free from Legacy Systems and Upgrade Your Core

Read the blog

Give Your Contracts a Closer Look

White Paper: Three Reasons to Give Your Contracts a Closer Look

DownloadLean On The Experts

You don’t have to do it alone. Our team of experts is waiting to help you.

Get Started